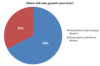

“Two-thirds of global executives state their supply chains are being developed to service growth in emerging markets”. This is one of the outcomes of a recent survey of 225 supply chain and corporate executives from global companies with annual revenues exceeding US$3-billion. The survey, conducted by Ernst & Young and the Economist Intelligence Unit (EIU) also found that almost four out of five respondents said they are “likely” or “very likely” to relocate a regional headquarters to an emerging market within the next three years.

“Two-thirds of global executives state their supply chains are being developed to service growth in emerging markets”. This is one of the outcomes of a recent survey of 225 supply chain and corporate executives from global companies with annual revenues exceeding US$3-billion. The survey, conducted by Ernst & Young and the Economist Intelligence Unit (EIU) also found that almost four out of five respondents said they are “likely” or “very likely” to relocate a regional headquarters to an emerging market within the next three years.

“These findings support both the significance of emerging markets (EMs) to the corporate growth agenda and the move toward global and regional centralization,” says the report. Supply chain leaders will increasingly be asked to contribute to better margins and drive revenue growth through expansion into the emerging markets of BRICSA: Brazil, Russia, India and China as well as South Africa. The researchers analysed feedback on key issues facing businesses as they position their supply chains for future growth:

Establishing an effective supply chain model and infrastructure

An optimised supply chain and infrastructure lie at the heart of the drive to boost EM revenues. 67% of the respondents believed that the supply chain is increasingly being developed to facilitate overall growth and 62% think that it helps to create a competitive advantage. Respondents felt that a regional approach will keep them close to their customers and that to be successful, they will need to find the right operating model and employ strong local talent.

Enabling new revenue sources

The survey shows that the number of companies expecting 50% or more of their total revenues to come from EMs will nearly triple over the next three years. The researchers concluded that companies must build up a strong market presence by understanding the consumer profile. An additional observation was that they need to “plot their route to market” taking into account the retail landscape and local demographics in every country.

Managing operational, tax and regulatory risk

The challenge will be to minimise the risk whilst improving turnover, cash flow and margins in these countries that can provide global organizations with significant growth. Risks can be contained through strong enterprise-wide corporate governance, consistent processes and controls and robust global compliance and reporting. More than 70% of respondents rated the risks of operating in an EM region as “very high” or “high.” The risks that ranked highest included: logistics and distribution capabilities (83%), reliability of suppliers (81%), finding and retaining qualified talent (77%) and import/export restrictions (77%).

So what are the implications for supply chain leaders?

Today’s business environment for large, global companies is more

fluid and complex than ever before. Companies are having to adapting their supply chains to respond to increasingly competitive market conditions. With slow revenue growth in mature markets, the supply chain must create sustainable cost savings in those markets to support margins and help pay for growth elsewhere.

With the economic downturn continuing to hamper growth in developed markets, many companies are shifting their attention to new revenue opportunities presented by the fast-growing EMs. Supply chain management is increasingly viewed as a powerful catalyst for helping companies secure new market share and drive revenue growth in these markets.

With the economic downturn continuing to hamper growth in developed markets, many companies are shifting their attention to new revenue opportunities presented by the fast-growing EMs. Supply chain management is increasingly viewed as a powerful catalyst for helping companies secure new market share and drive revenue growth in these markets.

This article was adapted by Elaine Porteous from the summary report issued by Ernst and Young entitled “Driving Improved Supply Chain Results – Adapting to a changing global marketplace” November 2010.

Elaine Porteous is an independent procurement specialist and writer on topical issues in supply chain.